Does your homeowners insurance cover sump pump backup? Water backup in your basement can be a homeowner’s worst nightmare. Not only do you have to deal with the mess, but you also need to think about who is responsible for covering the cost of damages caused by sump pump backup in your home.

It’s important to understand the types of insurance coverages offered when it comes to water backups, so you can make sure you’re protected from unexpected costs. In this article, we will explore how homeowners insurance and flood insurance interact when it comes to covering sump pump backups or other forms of water damage. We’ll explain what each type of insurance covers and why it is helpful for homeowners to understand the differences between these two coverage options.

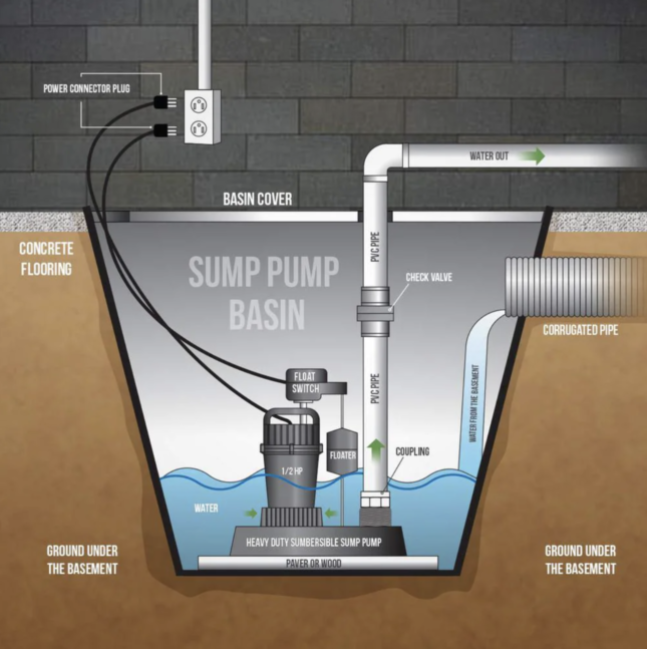

What is a sump pump and how does it work?

A sump pump is a device that helps prevent flooding in your home by pumping out excess water that collects in the basement or crawlspace. It works by sitting in a pit or sump, which collects water as it enters the home. When the water level reaches a certain point, the pump turns on and begins pumping the water out and away from the foundation of the house.

Here’s a great illustration and how to install from Bob Vila:

Sump pumps are essential for many homeowners. Without one, water can cause extensive damage to your home and possessions. Investing in a sump pump is a wise decision that can save you from costly water damage repairs in the future.

The typical cost of a sump pump is going to run you around $100 – $500. The price will depend on how many horsepower it has as well as whether or not it has a battery backup.

Having a battery backup for your sump pump is extremely important. Homeowners often times lose power during storms. It’s raining during those storms and that is a crucial time for your sump pump to be working.

If you already have a sump pump, but not a battery backup, you can always add one for around $250 – $750, depending on your current brand and setup. It’s not cheap, however when you consider that’s less than most homeowners insurance policy deductibles, it’s a wise investment.

Homeowners insurance vs flood insurance – what’s the difference?

This one often gets confused. Homeowners insurance and flood insurance are two separate policies.

Homeowners insurance typically covers damage caused by things like fire, theft, and severe weather, but it does not cover flooding caused by natural disasters.

Flood insurance, on the other hand, specifically covers flood-related damage. Think of flood insurance for storm surges, river and stream overflow, and flash floods.

It’s important to note that depending on where you live, if you have a mortgage on your home, your lender may require you to have flood insurance. The average cost of flood insurance in the US is about $950. However, this is highly dependent on your location and flood zone.

Just because you don’t live in a high-risk flood area doesn’t mean you don’t have the possibility from having damage. FEMA states that from 2014-2018 policyholders outside high-risk flood areas filed over 40% of all NFIP flood insurance claims and required one-third of federal disaster assistance for flooding.

Does homeowners insurance cover sump pump backup?

Typically, no. Not unless you add the optional coverage. It’s commonly referred to as “Sewer/Water Backup”, “Backup of Sewer or Drains”, or “Sump Pump Overflow”.

The additional cost to add water backup is usually around $50 – $250yr. The cost is going to depend on how much coverage you choose to have. It’s common to see $5,000 – $100,000. You need to determine the quality of the finishes in your basement as well as the value of your personal property.

Also, consider that it’s possible to have water backup damages in areas of the house other than the basement. Especially if your home has a crawlspace or slab.

We always recommend adding Sewer/Water Backup coverage. These are frequent homeowner claims. In our opinion it’s a no-brainer for the few extra bucks per year.

How to reduce your risk of a sump pump failure

Sump pump failure can be due to power outages, pump malfunctions from excessive rain, improper installation and just plain wear and tear on an old pump. In general, they should be replaced about every 7-10 years.

There are steps you can take to minimize the risk of a water backup, such as regular maintenance and inspection, backup battery systems, and the installation of a second pump.

How to test your sump pump

There are a couple ways you can test your sump pump. Unplug both the float switch and the motor. Then, only plug in the one going to the motor. The pump should turn on immediately. Remember to reconnect the other plug. This method ensures you have power however it won’t tell you if the system is fully functioning.

The other way is to take a 5 gallon bucket of water and pour it into the sump pit. This should be enough water the lift the float and run the sump pump. You should be able to see the level of the water go down.

Other ways to protect your home against water damage

Clean out your gutters to prevent water from collecting against the foundation. If your gutters become clogged they can’t direct water away from your foundation like they’re designed to do. Instead, the water drips over the side of the gutters and runs down the side of the house.

Inspect the ground around your foundation for proper grading. If the ground doesn’t slope down away from the house you can add soil to build up the slope. This will help guide water away from the house.

Use a hygrometer to measure humidity. It can sound an alarm so you can quickly tend to the problem before it gets worse.

By taking these preventative measures, you can help safeguard your home against water damage and catch small problems before they become big ones.

Free Policy Review

Has it been awhile since your agent has given your policy a thorough examination? When was the last time you had an annual review?

Just use our Policy Review tool and we’ll audit your policies and send back our recommendations. Free!

Of course, we’d love to eventually earn your business, but first we’d like to show our value.

Related Articles

Does Homeowners Insurance Cover Mold Damage?

Neighbor’s Tree Fell On My House. Who is Liable?

Homeowners Insurance Coverage Guide