Do you know if Service Line Insurance is included in your homeowners policy? Your service lines are integral to ensuring the basic functioning of your home – from having access to running water and gas, to powering lights and electronic appliances.

Overview of Service Lines

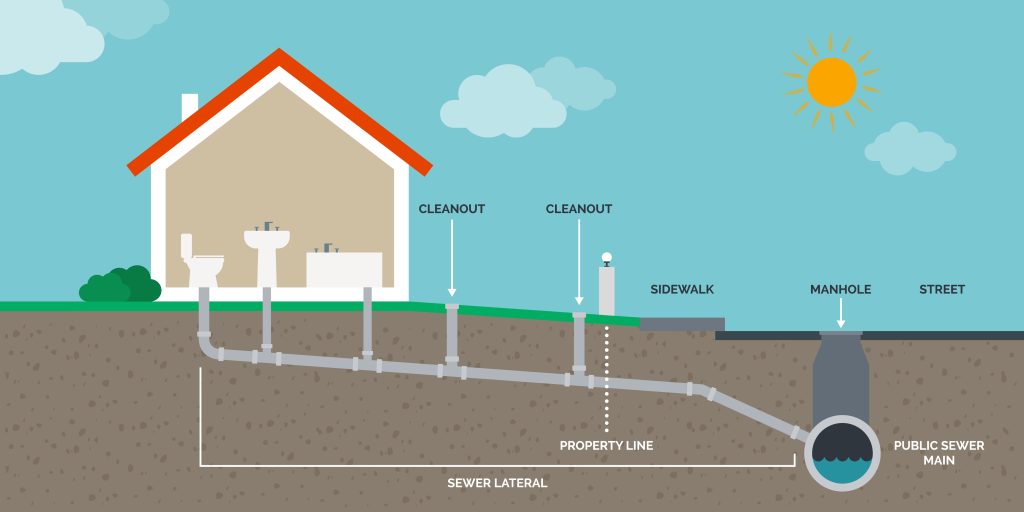

Service lines are systems that provide basic services such as electricity, water, sewer and gas to a home. Your service lines run from your home out to the main lines which are usually located near the street.

Common Types of Service Line Issues

Service line issues are common and can cause major headaches for homeowners. The pipe infrastructure in the U.S. is aging and the frequency of repairs is increasing.

According to the American Water Works Association, there is an estimated 240,000 water main breaks per year in the United States. Many of these breaks are due to corroding 100 year old pipes. Another contributing factor is freezing weather in certain parts of the country.

It’s important for homeowners to be aware of the signs of service line problems, such as low water pressure, slow drainage, and odd smells, so that they can address issues before they become more severe. Regular maintenance and inspections can also help to prevent these types of issues and keep your service lines functioning properly.

Who is Responsible for Fixing Damaged Service Lines

When a service line is damaged, it can be a stressful situation for both the property owner and the utility company. However, the question remains: who is responsible for fixing the issue? In most cases, the answer depends on where the damage occurred.

If it happened on the homeowner’s property, then they are typically responsible for repairs. On the other hand, if the damage occurred on the utility company’s side of the line, then it is their responsibility to fix the issue.

Of course, there are exceptions to these general rules, and other factors such as negligence may come into play. Regardless, it is important for both parties to communicate and work together to determine the best course of action for resolving the issue as quickly and efficiently as possible.

Service Line Insurance on Homeowners Policy

Many insurance companies offer optional coverage on your homeowners insurance for service lines. Some companies will package together coverage options and offer Bronze, Silver and Gold type plans. Others may require you to separately add this coverage. In either case, you’ll want to discuss with your agent to be sure.

What is Covered?

You need to refer to your policy to verify exactly what is covered because not all insurance companies will be the same. That’s my disclaimer!

- With that being said, here are some common covered costs:

- Excavation costs

- Outdoor property damage

- Costs to bring the service lines up to new standards

- Additional living expenses

These may be covered due to leaks, breaks, tears, ruptures, collapse, or electrical arching of a buried utility line.

What is Not Covered?

There are some common exclusions we see with a lot of insurance companies. Again, this is what is typical, but may not be the case for your policy.

Any part of any underground pipes or underground wires that is beneath or within a body of water, including swimming pools, ponds, lakes, or streams.

Any part of any underground pipes or underground wires that is beneath or within the dwelling or other structures on the “residence premises”.

Any underground pipes used to supply water to outdoor property, including swimming pools, hot tubs, fountains, or ponds.

Any underground pipes or underground wires that are not connected and ready for use.

Is There a Deductible?

Some policies will have a separate deductible for service line coverage. However, this may be to your advantage because typical homeowners insurance deductibles tends to be $1,000 – $2,000. Whereas, a common service line deductible is $500.

How Much Coverage Can I Get?

Coverage limits are pretty limited with a lot of insurance companies. They may only offer a single option such as a $10,000 limit.

How Much Does Service Line Insurance Cost?

There are going to be many different factors that determine your cost. Pricing for homeowners insurance in general takes into account your credit score, claims history, location of the home, amount your home is insured for and more.

On average you should probably expect Service Line coverage to add about $50 – $100 per year to your homeowners insurance policy cost.

What to Do if I Have a Service Line Insurance Claim

Dealing with service line issues can be frustrating and overwhelming. However, there are steps you can take to get the help you need. First, you need to contact your insurance agent.

This doesn’t mean you are automatically filing a claim. You just need to have the conversation and seek the advice of your agent. They can get you started on the right track.

Many times people fear contacting their agent because they’re worried about their homeowners insurance cost going up from filing a claim. You’re not committing to filing a claim yet. You’re simply working with your agent to determine what your options are.

On top of that, if you don’t put your insurance company on notice of a possible claim, they may deny or only partially cover your claim. The reason is if you have possible damages to your home, you have the responsibility to immediately stop or reduce further damage. This is stated in every homeowners insurance policy.

Should I Purchase Service Line Insurance?

We hope this article has helped you determine whether or not you should purchase service line insurance. Ultimately, it is up to you and the level of risk you are comfortable with. If you live in an older home, naturally the risk is higher.

If you have a significant emergency fund set aside maybe you decide you’d rather self-insure than purchase coverage.

Whatever you decide we always recommend having the conversation with your insurance agent. That way you’re armed with the information necessary to make an informed decision.

Related Articles

Does Homeowners Insurance Cover Sump Pump Backup?

Does Homeowners Insurance Cover Mold Damage?

Does Homeowners Insurance Cover Storage Units?